Hey there, Party Planners! We have some interesting news from the world of business and economics – https://pbn.com/pbn-survey-economy-election-putting-business-on-edge/. Providence Business News has recently featured Caliella, and we have some intriguing details to share with you. This feature goes beyond just pretty decorations and creative balloons – it delves into a few businesses weathering the current state of Rhode Island’s economy.

In this article, we will explore Providence Business News’ story. Additionally, we will delve into the challenges that Rhode Island businesses are currently facing. To provide you with valuable insights from the latest PBN Survey.

Caliella’s Creative Event Design Approach

At Caliella, we have been navigating the Rhode Island event scene for over 1-year now. Our approach focuses on creating unforgettable experiences that surpass mere aesthetics. We believe in evoking emotions and leaving a lasting impact with our creative designs, installations and customer service. Our team is dedicated to bringing brands to life through meticulously selected themes, while using the highest quality balloons/party supplies.

PBN SURVEY: Economy, election putting business on edge (Providence Business New’s Article)

https://pbn.com/pbn-survey-economy-election-putting-business-on-edge

(reference article by Jacquelyn Voghel, 09/27/2024)

Rhode Islanders aren’t throwing parties like they used to just a year ago. At least, that’s the way Ines Gentile sees it.

Gentile is a balloon artist and owner of Caliella LLC, an event design company in North Providence that has adorned festivities in Rhode Island and southeastern Massachusetts. Though a relatively new business – Gentile launched Caliella about a year ago – her balloon displays can be found at events ranging from weddings and birthday parties to corporate holiday gatherings.

But lately, her customers have been reining in the frills. They “are strategizing a little different,” Gentile said. “Cutting costs on decorations and [focusing] more on essentials, like food.”

Is it any surprise?

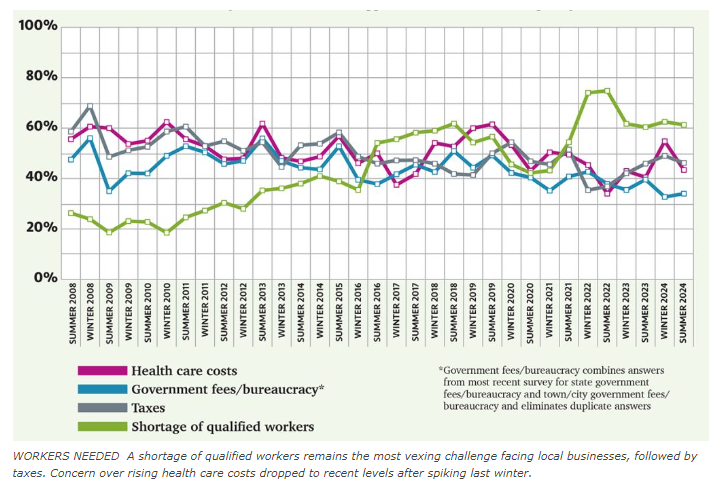

WORKERS NEEDED A shortage of qualified workers remains the most vexing challenge facing local businesses, followed by taxes. Concern over rising health care costs dropped to recent levels after spiking last winter.

Inflation has cooled, but prices are still perceived as being too high. Meanwhile, the labor market, once nearly at full employment, has shown signs of weakness, with Rhode Island’s jobless rate at 4.6% in August, two-thirds higher than it was a year ago. And housing costs, from monthly rent to homeownership, remain sky high.

Then there’s the stormy presidential election looming in November, a tight contest between two candidates with drastically divergent views on how to run the country.

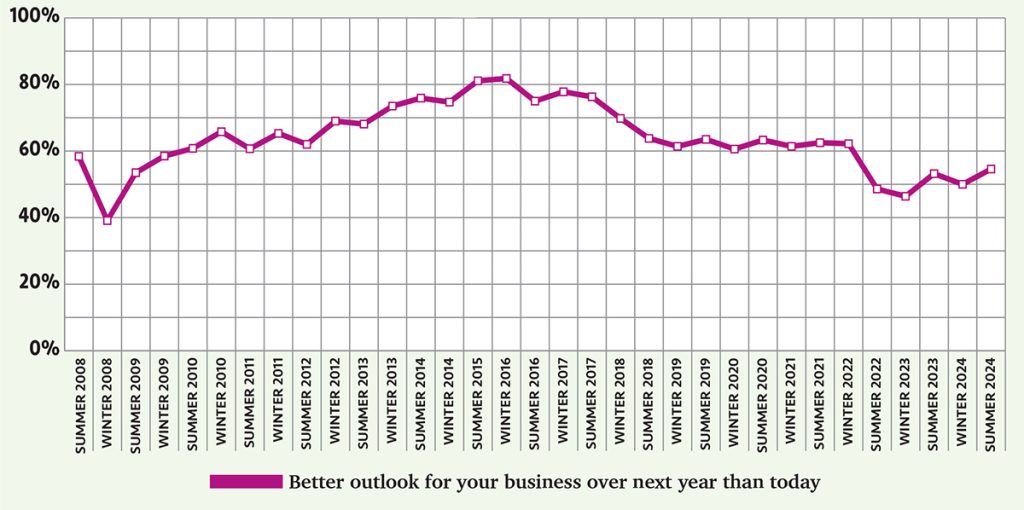

Indeed, the Providence Business News’ Summer 2024 Business Survey shows that local companies are feeling anxiety about the state economy in the year ahead, even as their predictions for their own future are rosier.

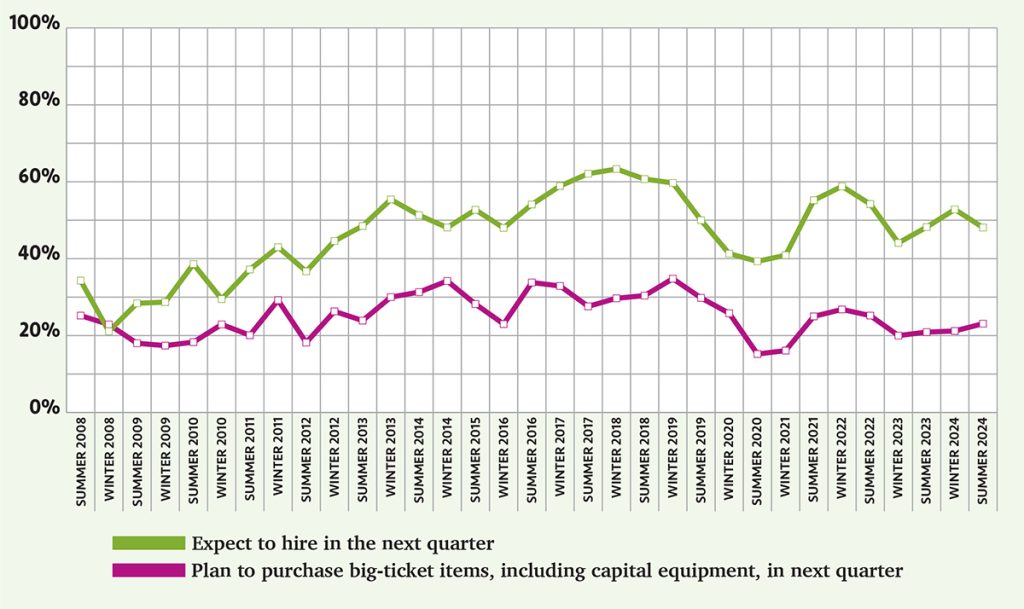

WAITING FOR MORE Easing inflation has not yet convinced companies to commit to big-ticket purchases, though about half still have enough confidence in themselves and the local economy to continue hiring.

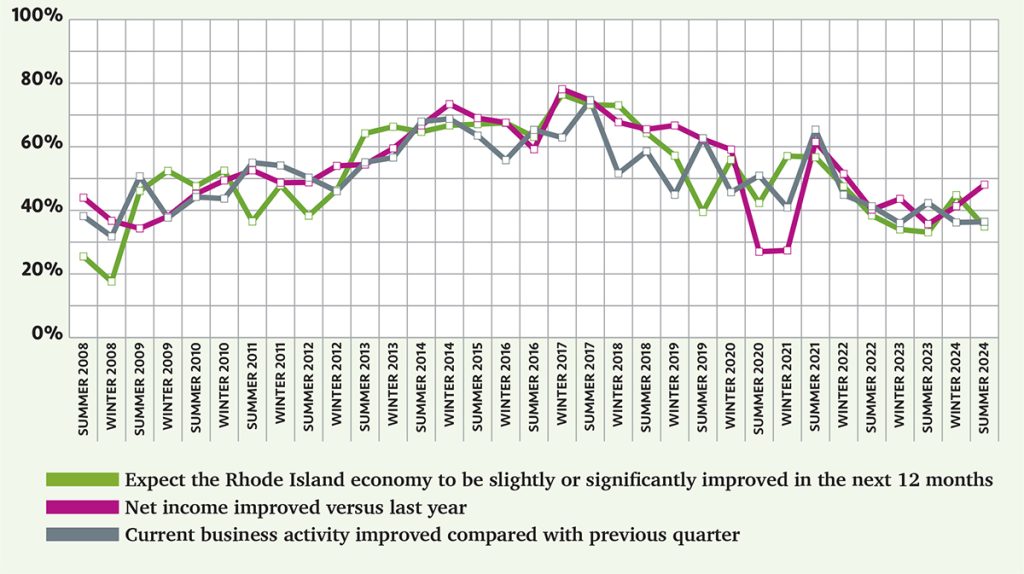

About one-third of the business owners and executives who responded to the biannual survey – 34.9% – said they foresee Rhode Island’s economy improving slightly or significantly in the next 12 months, down from 44.8% six months ago and a far cry from when that number peaked at 76.4% in the winter of 2017.

At the same time, however, a little more than half the respondents hold a positive outlook for their own businesses, with 54.6% projecting that their companies would be doing better a year from now, a rate that’s held relatively steady since the low point of 46.4% in the winter of 2023. Meanwhile, only 3.7% take a pessimistic outlook – down from the 11.5% who were bracing for deteriorating business in the winter survey six months ago.

Edward M. Mazze, a distinguished professor of business administration at the University of Rhode Island, says those hints of optimism among those surveyed could be a lingering effect of the COVID-19 pandemic. Many businesses may feel that they couldn’t sink much lower than the situation a few years ago during the economic shutdown.

Businesses “are more optimistic than they’ve been in some of the previous surveys,” said Mazze, who helped PBN develop the survey in 2008. “I don’t think [that] is a surprise to anybody because we went through the COVID experience and have had kind of a screwy economy.”

MIXED FEELINGS

The PBN survey, which has been conducted twice a year since 2008, is not scientific. PBN sent 22 questions to 1,454 businesses statewide in the newspaper’s database. One hundred nine returned the survey, a mix of businesses ranging from manufacturers to banks, construction contractors to lawyers, retailers to real estate agencies. While the respondents included some of the state’s largest employers, most were small and midsize companies.

The survey results indicate that, so far, 2024 has been so-so for most Rhode Island businesses.

PROFITS UP Business activity is stagnant and well below historical norms but companies reporting year-over-year profits jumped to their highest level since 2022. Confidence in the state economy over the next year, however, slipped from last quarter to 2023 levels.

Nearly half of the respondents – 48.1% – say their net income has improved over the same period a year ago. That’s the highest percentage since the winter of 2022, when 51.5% reported an improved net income. But a little over one-third of the survey takers (36.4%) say their business activity in the current quarter of this year has been better than the previous quarter, almost identical to the results six months ago but a number that has averaged 52.4% in surveys over the last decade.

It’s in this economic environment that Gentile has had to operate Caliella, with the reduced business activity requiring some extra legwork to stay afloat. Gentile finds herself putting in extra time to work with clients to reach affordable designs for events. She says she has accepted that at least for now, she’ll have to settle for smaller sales in many cases.

Her husband, Gian Gentile, who is helping with the business, says that closing on sales now requires more finesse when working with customers.

“We try not to just give a flat rate on what [the cost] will be but have an open conversation where we don’t just push away a potential client on sticker shock with pricing,” he said. “You kind of have to be flexible without selling yourself and your service short, but also not losing potential business by overpricing based on the current state of the economy.”

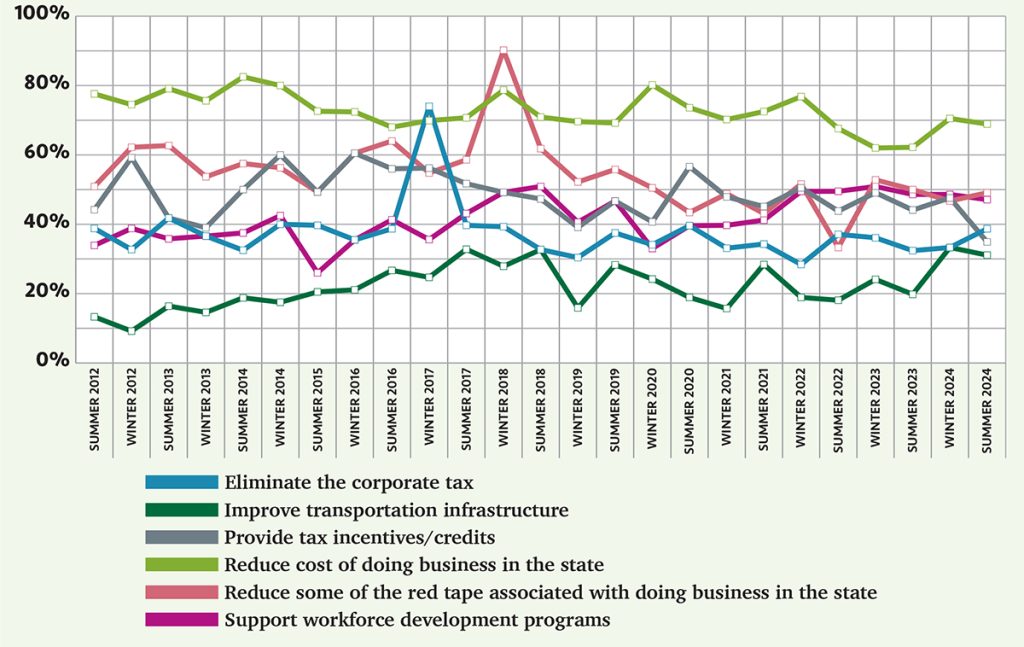

LESS PLEASE State government can do more to lower business costs, according to nearly 7 in 10 survey respondents. About half say they’re also hindered by too much government red tape.

Gian Gentile is also CEO of Industrial Security and Investigators Inc., a full-service security company that does business as SecurityRI.com.

That company, which employs about 100 people, has seen its own set of challenges. While the company has typically upheld strong hiring and revenue trends, late summer presented more of a challenge.

“We always seem to be hiring … but it has been kind of at a standstill for us for the past month or so,” he said.

Gentile suspects a slowdown in business is related to the uncertainty in recent months about if and when the Federal Reserve would cut interest rates and the presidential race between Vice President Kamala Harris and former President Donald Trump.

He believes many clients are waiting on the election results before they make big financial decisions.

PBN PHOTO/MICHAEL SALERNO

But some other businesses, including Trico Specialty Films Inc. in North Kingstown, see more reason for optimism.

“We were going through this period of time where there’s been lots of uncertainty … but from our perspective, our customers have been placing regular orders and our sales pipeline is full,” said Paul Conforti, Trico’s chief financial officer.

“We’ve been operating a new facility for about three years,” he said. “And I would say the first couple years were characterized by more volatility, and this year has been more consistent.”

This positive trend at Trico – which manufactures polypropylene film used in products such as labels, graphic advertisements, window panes, solar panels and teeth whitening strips – also bodes well for the overall economy, Conforti says, given the business’s broad range of industries served.

Still, Trico’s clients don’t represent the entirety of the economy, Conforti acknowledges. The company typically contributes to “commercial or more utilitarian-type products,” he said, rather than items that fall under discretionary services, such as those offered by Caliella.

LOOKING UP Uncertainty about the overall economy doesn’t mean business owners aren’t hopeful. More than half expect their own companies to be doing better a year from now.

AT WHAT COST?

No matter the economic climate, there’s never a shortage of obstacles facing Rhode Island businesses.

In the latest PBN survey, the shortage of qualified workers remained at the top of the list, with 61.3% of respondents saying it was the biggest business challenge (up from 60.4% a year ago), followed by taxes (46.2%, up from 45.9% a year ago) and health care costs (43.4%, up from 40.5% last summer).

At the same time, health insurance and the salaries of new hires are tied at the top of the list of the biggest growing expenses at 35.5% each.

At the PACE Organization of Rhode Island, part of a national nonprofit organization providing elder support services, CEO Joan Kwiatkowski says her group’s expenses for insurance coverage, including health and liability, are exceedingly high compared with other PACE entities nationwide.

PACE Rhode Island’s overall insurance costs have increased 67% in recent years – a figure that means “compared to any other PACE organization across the country, we have the highest cost” for insurance, Kwiatkowski said.

And while the organization has avoided the staffing shortages that have plagued the health care sector since the COVID-19 pandemic, Kwiatkowski says the industry remains too unstable for comfort. As the need for elder care increases, it’s crucial that PACE can keep up with demand, she says.

“We are right now able to keep up with staffing, but I know that’s not the case for many of our colleagues” in the industry, Kwiatkowski said. “I could be in their shoes tomorrow.”

When asked about important actions state government could take to support business in the year ahead, executives continued to place reducing the cost of doing business in Rhode Island highest on the to-do list, with 68.9% of those surveyed marking that as important, up from 62.2% a year ago.

One notable change in responses to that question was that 31.1% of those surveyed said improving transportation infrastructure was crucial. While that ranked lowest, it was a significant jump from the 19.8% who marked it a year ago, before the emergency closure of the westbound Washington Bridge last winter.

Since then, many businesses – particularly in the East Bay, the East Side of Providence and surrounding communities – have experienced a loss of customer traffic and an unforeseen economic fiasco, this time in the form of an infrastructure failure.

At the same time, when asked to rank the greatest benefits of operating in Rhode Island, “access to transportation” was marked by only 16.7% of the respondents, down from 26.2%. At the top of the list was proximity to customers (77.5%, up from 68.2% last summer) and quality of the labor force (27.5%, up slightly from 27.1% a year ago).

It’s clear that while inflation has eased significantly from the highs of 2022, when the rate averaged 8%, it’s still creating issues for businesses. The inflation rate remains about a half a percentage point above the 2% that is generally deemed healthy for the economy.

The reduction in inflation still hasn’t been enough for many businesses to feel comfortable about making big-ticket purchases such as capital equipment in the next quarter. Less than a quarter of the respondents (23.1%) said they planned to make such purchases in the near future, up slightly from a year ago (20.9%).

At the same time, 21.5% of companies said they planned to raise prices in the next quarter, up from 16.7% from a year ago. And while the number of respondents who said they were paying higher prices for materials and supplies compared with last quarter declined from 76.6% in the summer of 2023 to 70.5% in the most recent survey, that percentage remains high.

Ted Benz, president of Benz Co., a Providence-based manufacturer of laboratory and testing equipment, has seen the price increases and their ripple effects on business activity.

His company – which was established in 1967 and serves about 20 customers globally – has contended with increased costs of goods and prices. One aluminum component that cost Benz $850 about six months ago has risen to $1,280.

Benz says it’s typical for business to slow somewhat in the summer, but the summer of 2024 had been particularly sluggish.

“I can see the reluctance there, all of the sudden,” Benz said. “You’ve got a very expensive product now that certainly wasn’t budgeted for” by customers.

“It seems like everyone went on vacation in August,” he said. “I just didn’t expect it to be so extreme.”

When asked how inflation has affected their business, a larger percentage of the respondents (6.7%) said there was no effect compared with the 1.8% who gave that answer a year ago. But a majority – 57.1% – said it would mean their company would have to raise wages (down from 62.2% a year ago,) and 55.2% said it would raise their fixed costs (down slightly from 55.9%).

A smaller percentage of survey takers – 42.9% – said they would have to pay more for materials (down from 51.4% a year ago), although 48.6% said they would have to increase their prices (up from 45.9% in the summer of 2023).

At Caliella, owner Ines Gentile is feeling the squeeze in more ways than one.

In addition to her customers cutting back on event decorations, suppliers have been charging more for materials.

The business has stopped using helium, one of the components most closely associated with party balloons, because it has become cost-prohibitive.

“It’s a resource that is scarce at the moment,” Gentile said.

The higher prices, coupled with new service fees from vendors that are also feeling pricing pressures, make it challenging to remain upbeat right now.

“A lot of [sources] for my balloons and party supplies for events in the past didn’t charge for shipping, and now they do,” Gentile said.